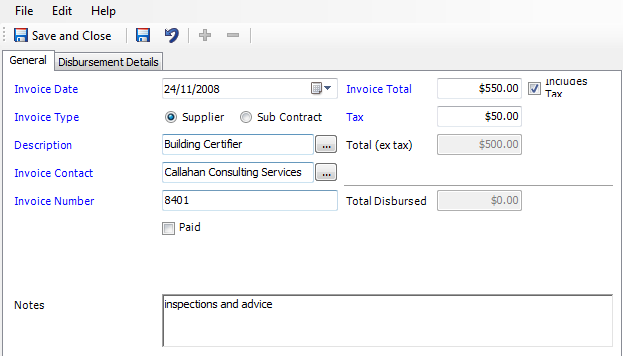

Enter a description of the expense. The note entered here can be configured

to appear on the invoices, and can

be edited within the invoice wizard.

Units, Unit value and Total value

Mostly the unit value of 1 is entered. However this can be a useful

tool to track units, here is a scenario:

Example

Bill Jones has provided an invoice for $1980

(including GST). The invoice covers services for

2 projects. On his invoice he's indicated the following:

|

Project

|

Hours

|

Charge

|

|

Paradise

villas

|

10

hours @ $80

|

$800

|

|

Windsor

Rd bus shelter

|

12.5

hours @ $80

|

$1,000

|

|

This claim

|

|

$1,800

|

the

invoice values that will be allocated to the project in Synergy

are ex GST

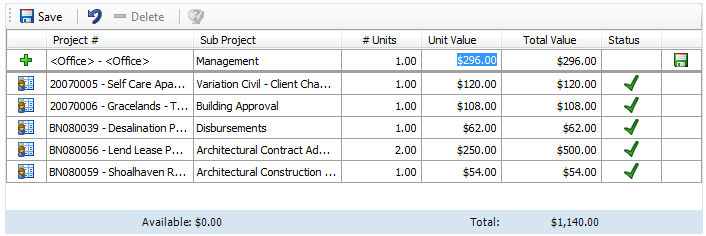

This can be added to Synergy in

the following way:

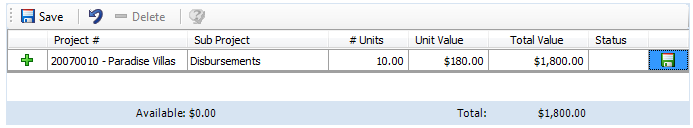

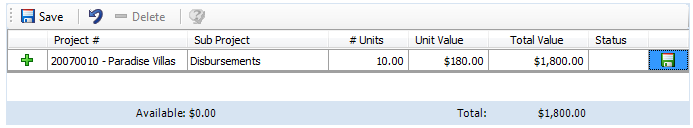

- For the first project enter 10 in the # units.

- For the first entry the system will want to disburse

the whole invoice across one project, but it will come down to modifying

the Unit value:

The Unit value will automatically be calculated

to $180 which is Total divided by units. So you will need to type

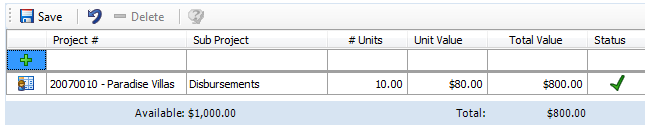

the charge per hour under Unit value of $80.00:

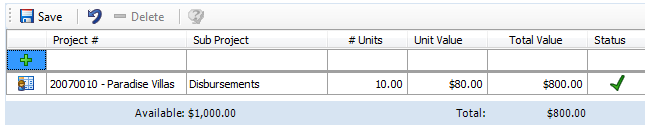

- The Total value will now calculate Units

x Unit value i.e. 10 x $80.

- The second and final project listed will automatically

assume the balance of the invoice be allocated, again, you will just need

to enter the # units of 12.5 and the Unit value will calculate automatically

also.

if the # units is set to 1, then the

unit value need only be changed to specify the total value (ex GST)

to be disbursed to the project.

if the # units is set to 1, then the

unit value need only be changed to specify the total value (ex GST)

to be disbursed to the project.

Supplier Bills module was re-designed in the 4.9.4 release.

Supplier Bills module was re-designed in the 4.9.4 release.