| Who Can Use It? | Where Is It? |

|---|---|

|

Director System Administrator |

Practice > Rates |

| Who Can Use It? | Where Is It? |

|---|---|

|

Director System Administrator |

Practice > Rates |

Tip: Learn more about Adding an expense to a project.

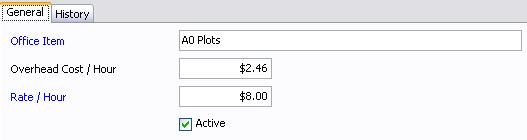

Description for the office item will appear when estimating budgets, when allocating to a sub project and on project reports and invoices.

The estimated cost per item e.g. how much will each item cost the company including overhead. The cost you nominate will calculate on the financials of the sub project and reports under the 'Cost' headings. This figure is not invoiced to the client. The difference between the cost and rate/item (charge) is the profit.

Example

An A0 print will be charged out at $8.00. There are 3 options to work out the cost.

The A0 plots cost is $2.46 and the charge is $8.00. The profit value here will be $5.54 per item each time it is used.

The estimated charge out rate per item. If a drawing charge out is $5.00 and you use 5 drawings on a sub project, the charge to the client will be estimated at $25.00.

When the cost and charge are first set for a new office item rate, the effective date will set automatically to the date of creation. Though when changing the office item rate you will have the ability to set an effective date.

An effective date sets the item cost and charge from a particular date. All Transactions allocated to the item prior to the new effective date will be calculated using the previous cost and charge and all transactions allocated from the effective date will be calculated at the current cost and charge - until such time a new effective date is set.

Looking for more help? Try reviewing the following Practice topics: ![]() View Topics

View Topics

Or try reviewing the following Rates topics: ![]() View Topics

View Topics

© 2019 Total Synergy Pty Ltd