Apply a credit for Supplier expense already invoiced

If you've raised an invoice that incorporated a Supplier Expense, it

is locked down and cannot be changed. This will

prove challenging if a credit is issued for some or all of the Supplier

expense. Here we work through the steps to enter

the credit.

Create a negative office item

- Go to Practice > Rates.

- Select New.

- Provide a Description such as Discount or Credit.

- Cost per unit and Charge per unit should be -$1.00.

- Save and Close.

Enter a negative office expense

- Open the project the credit is to be entered against.

- Select Transactions, then Add New Office Expense.

- Select the Sub Project.

- Select the Credit rate.

- The date should be the date of the original Supplier

Invoice.

- At Units enter a number that represents the Credit amount

- don't worry about the negative symbol.

- Type a note that reflects who the Supplier was and why

there is a credit.

- Save.

Write off the expense

Even though the original supplier expense is in the system and attached

to the Invoice, writing the office item off will create a negative cost

and charge item that will recalculate the project profitability.

- Select the Time and Expenses tab.

- From drop down at the screen filter, select WIP or Expenses.

- Locate the negative Office Item.

- Select Write Off.

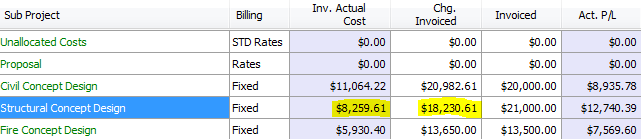

Before the write off

Here is a look at the sub project Profitability tab.

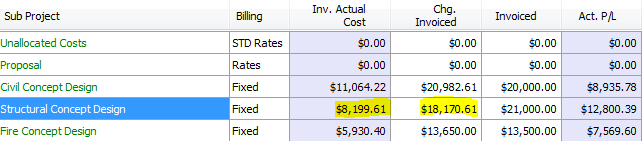

After the write off

A $60 credit was entered against the sub project and then written off

- notice the Inv. Cost has gone down after the office item credit is written

off.

Want to learn more?

Looking for more help? Try reviewing the following topics:  View Topics

View Topics

©

2019 Total Synergy Pty Ltd

Open topic with navigation

![]() View Topics

View Topics